Auto insurance plays an important role in protecting drivers, passengers, and vehicles on Tennessee roads. Every driver in Tennessee needs to understand the different types of auto insurance available to make informed decisions. By exploring the basics and various coverage options, you can choose a policy that safeguards your finances and meets state requirements.

Understanding the Basics of Auto Insurance in Tennessee

Auto insurance in Tennessee serves as a safety net for drivers, providing financial protection in the event of an accident. The state requires a minimum amount of coverage, but many drivers opt for additional protection. Insurers in Tennessee offer a variety of policies, allowing drivers to tailor coverage according to individual needs.

In Tennessee, the law requires all drivers to carry at least a basic form of auto insurance. Without it, you may face fines, license suspension, or even vehicle impoundment. However, understanding the minimum requirements is only the first step, since additional coverages can provide broader protection.

Many people new to auto insurance might feel confused by the different terms and policy options. Fortunately, agents can help explain the distinctions between required and optional coverage. By learning about these options, you can make choices that reflect your lifestyle and driving habits. In addition, researching different providers may help you find the best rates and customer service.

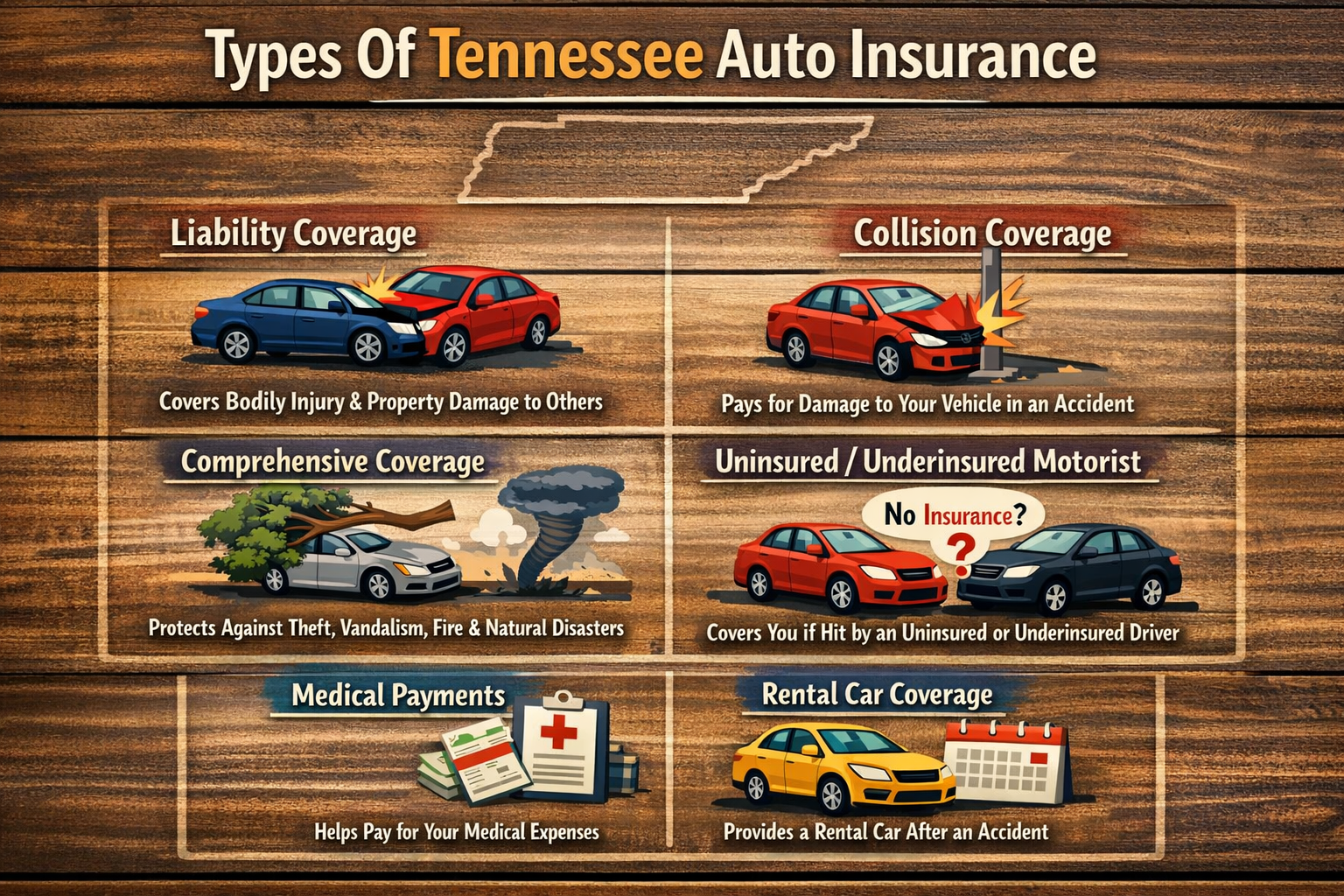

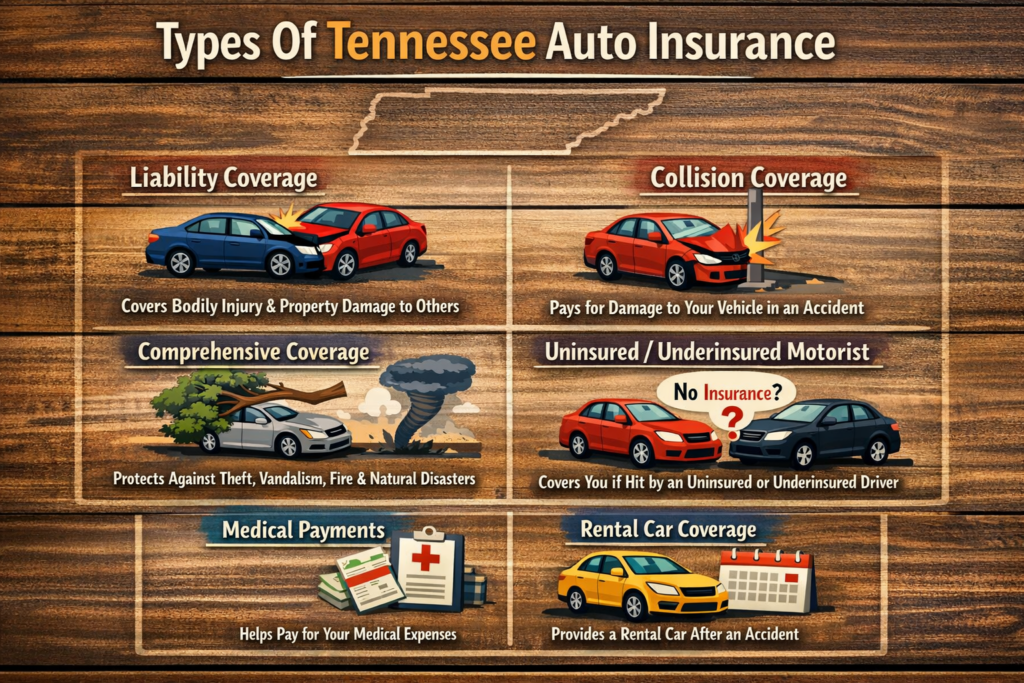

Liability Coverage: Required Protection for Drivers

Liability coverage forms the cornerstone of auto insurance in Tennessee. The state requires all drivers to carry liability insurance, which pays for damages or injuries you cause to others in an accident. Minimum limits in Tennessee include $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $25,000 for property damage.

Choosing the state minimum might seem adequate, but accidents can quickly exceed those limits. If the damages exceed your policy limit, you would be responsible for the remaining costs. Many drivers choose to increase their liability limits for extra peace of mind and to avoid financial hardship after a major accident.

Having liability coverage not only satisfies legal requirements but also protects you from lawsuits and claims. When you cause an accident, your insurance can step in to cover medical bills, repair costs, and legal fees. By maintaining adequate liability insurance, you can drive confidently, knowing you are meeting the state’s demands and protecting your assets.

Comprehensive and Collision Coverage Explained

Comprehensive and collision coverage offer added protection beyond liability insurance. Collision coverage pays for repairs to your own vehicle after an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, protects against non-collision events like theft, vandalism, fire, or weather damage.

While Tennessee does not mandate these coverages, many lenders and leasing companies require them for financed vehicles. Even if your car is fully paid off, you may want to consider both options to avoid expensive repair bills after unexpected incidents. Repairing or replacing a vehicle can cost thousands of dollars, making comprehensive and collision insurance a sensible investment.

Drivers appreciate the added security these coverages provide, especially in areas prone to severe weather or high rates of theft. Comprehensive and collision policies usually come with deductibles, which you can adjust to fit your budget. By weighing your vehicle’s value and your financial situation, you can select the right level of protection.

Optional Add-Ons and Specialized Policies Available

In addition to the standard coverage types, Tennessee drivers can choose from a range of optional add-ons. Uninsured and underinsured motorist coverage protects you if another driver lacks adequate insurance. Medical payments coverage, or MedPay, helps cover medical expenses for you and your passengers after an accident, regardless of fault.

You may also want to consider roadside assistance coverage, which offers help if your car breaks down or you get locked out. Rental reimbursement coverage pays for a rental car while yours is in the shop after a covered claim. Gap insurance can be valuable for those with new or financed cars, as it covers the difference between your car’s value and the amount you still owe on your loan if the car is totaled.

Specialized policies exist for unique vehicles such as classic cars, motorcycles, or recreational vehicles. Insurers may also offer usage-based programs that reward safe drivers with lower premiums. By exploring these optional add-ons and specialized policies, you can create a customized plan that offers complete protection.

Choosing Different Types Of Auto Insurance In Tennessee for Your Needs

Selecting the right auto insurance in Tennessee involves assessing your personal situation, vehicle value, and driving habits. Start by reviewing the minimum legal requirements and considering whether you need higher liability limits for added security. Evaluate your vehicle’s worth and your ability to pay for repairs or replacement out of pocket, which can help you decide on comprehensive and collision coverage.

You should also consider the benefits of optional add-ons, such as uninsured motorist, medical payments, or roadside assistance coverage. Gathering quotes from several providers lets you compare prices and coverage options, ensuring you get the best value for your money. Consulting with a knowledgeable agent can clarify confusing terms and help you identify gaps in your protection.

Review your policy annually, since life changes such as moving, buying a new car, or adding drivers can affect your insurance needs. Staying informed about available discounts, such as safe-driving or bundling discounts, can help lower your premium. Choose a reputable insurer with strong customer service and claims support, as this can make a difference when you need help most.

Conclusion

Understanding the different types of auto insurance in Tennessee empowers drivers to make informed choices that protect both themselves and others on the road. By learning about liability, comprehensive, and collision coverage, as well as optional add-ons, you can build a policy that fits your budget and lifestyle. Taking time to compare providers, read reviews, and consult experts ensures you not only meet legal requirements but also gain valuable peace of mind. Your needs may change over time, so it is important to review and update your coverage regularly. Protecting your vehicle and financial well-being starts with a smart insurance decision. You should never settle for the minimum if you can afford better protection.